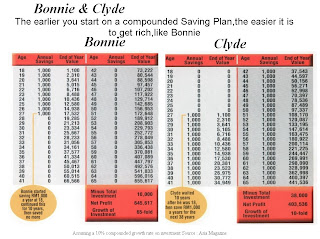

Although he save RM1,000 a year for the next 38 years, he still cannot match the amount of money that Bonnie gets for saving only 10 years at the early age of 18. The earlier you start the lesser amount you have to save and you don’t have to seek a very high interest rate.

As it goes the higher the interest rate, the higher the risk that you have to put up with. So if you start early you can put your money in a moderate unit trust fund and still get a higher gain. You don’t have to go through the high volatility of a direct stock investment or the aggressive/high risk unit trust fund. So the best advice is start saving or investing now!.