Monday, December 17, 2007

Another New Goals to conquer!

Well in the meeting that I can only hear but cannot see the speaker or the screen...the speaker had announce the 2008 Challenge and Incentive trip. It is Rome, Italy and Guangzhou & Gulin,China.

I didn't make it for this year Incentive trip...too busy doing other things..:)

In the meeting The Public Mutual rep also announce:

1) Starting 1/1/2008 all EPF investment service charge will be 3%. A drastic decrease of comission for the UTC also due to this :(

2) Starting 1/1/2008 also all cash investment service charge will be 5.5% only. Another decrease in the comission for the UTC. But good news to all investors and would be investors out there..:)

But good news to UTC the FD savings of individuals did not decrease at all despite the buying spree of Public China Ittikal Fund amounting to RM 1 Billion. In October it stood at RM225,445.5Million. According to the rep the FD amount is more than that currently. So it means that they are a lot of cash rich individuals that are waiting for all UTC out there to coax them to invest in a better investment vehicle. So good luck to all UTC out there...remember the person sitting next to you may be the depositor..:)

Tuesday, November 20, 2007

New Fund is LAUNCHED !!!!!!!!!!!!!!

During promotional period from 20November to 10 December 2007 it will be selling at 25cents per unit with a 5.45% service charge.

So folks out there grab this great opportunity to receive great return for your hard earned money. For further information regarding the fund you can go to http://www.publicmutual.com.my/

Tuesday, August 21, 2007

PIDF will be accepting EPF sales (including switching sales) with effect from 20 August 2007.

Thursday, August 16, 2007

Single pricing... How many units will I get and how much shall I pay for my investment?

A single pricing regime will be introduced at the beginning of the second quarter 2007 to ensure there is full transparency and disclosure of up-front costs. Unlike the current dual pricing regime where prices are quoted inclusive of charges, under the single pricing arrangements, prices will reflect the net asset value of a unit and all charges will be separately disclosed. The enhanced transparency of prices and charges will allow investors to compare the costs of investing in unit trusts associated with different channels of distribution and should lead to a more competitive cost environment.

So with this new ruling how many units will you get and how much shall you pay for your investment?

Below is an example of how the calculation is done when the fund NAV per unit is RM0.2500.

Units credited to your account:

= RM10,000/RM0.2500

= 40,000 units

Service charge per unit :

= RM0.2500 x 5.45%

= RM0.013625

Total service charge incurred:

= RM0.013625 x 40,000 units

= RM545

Following the above, the total amount you should pay will be:

= Amount invested in PIABF + Service charge incurred

= RM10,000 + RM545

= RM10,545

Monday, June 25, 2007

EPF new regulation..

Due to this new directive Public Mutual will only accept EPF investment for the following funds with effect from 2nd July 2007:-

1) Public Regular Savings Fund (PRSF)

2) Public Index Fund (PIX)

3) Public Islamic Balanced Fund (PIBF)

4) Public Select Bond Fund (PSBF)

5) Public Money Market Fund (PMMF)

6) Public Islamic Money Market Fund (PIMMF)

The new EPF investments into the above 6 funds made from 2nd July 2007 onwards are only allowed to be switched within these funds and any other funds which may be approved later.

Public Mutual also will be running a Special Promotional Service Charge of 5.45% (instead of the usual 6.5%) on all EPF investment invested into PRSF, PIX and PIBF from 2nd July 2007 until 31st July 2007.

The above 6 funds will not be investing abroad. So EPF investor grab this great discount, a big saving in service charge!

Thursday, May 17, 2007

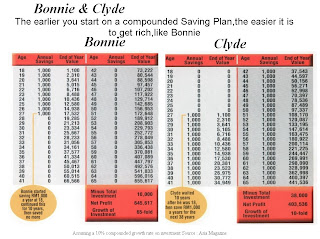

Gold for the Early Bird

Although he save RM1,000 a year for the next 38 years, he still cannot match the amount of money that Bonnie gets for saving only 10 years at the early age of 18. The earlier you start the lesser amount you have to save and you don’t have to seek a very high interest rate.

As it goes the higher the interest rate, the higher the risk that you have to put up with. So if you start early you can put your money in a moderate unit trust fund and still get a higher gain. You don’t have to go through the high volatility of a direct stock investment or the aggressive/high risk unit trust fund. So the best advice is start saving or investing now!.

Monday, May 7, 2007

Eight Golden Rules Of Investing.

- Do Not Borrow To Invest.

- Do Not Invest All Your Money.

- Do Not Invest Money You Need Soon

- Do Not Get Emotional And Panic

- Do Keep Investing And Stay Invested

- Do Diversify

- If an investor invest all his money in a single stock, when the price falls

- Do Take Professional Advice

- Do Give Your Investments Time To Grow.

If an investor were to invest his money in a single stock counter, he could lose all of his money if the company went into liquidation. A unit trust spreads the risk off loss by holding a portfolio of stocks which behaves in a less volatile manner. It means less sleepless night for you.

Monday, April 16, 2007

Fund can Invest More in the Overseas...

Bank Negara Malaysia has relaxed rules to allow unit trust companies to invest half of their total net asset value (NAV), or the market value of their investments, up from 30 per cent previously.

This means that unit trust firms will be able to offer additional units in funds that invest overseas.

Such funds have been selling well, but unit trust managers have complained that most of them are close to hitting the ceiling in terms of foreign investments.

"This is good news for unit trust players to come up with more global funds which will give more choices for investors to diversify their investment portfolios," Amanahraya Unit Trust Management Sdn Bhd chief executive officer Roslan Harun said.

"I personally think the figure should be more than 50 per cent of the NAV as local investors' appetite for global funds now is on the rise."

He said investors do not want to be restricted to only investing in the local market.

The announcement could entice one or two unit trust companies to focus only on global funds, he added.

"Players now can come up with products that could actually focus on specific countries, such as China and India, apart from the US and Europe," said Roslan , adding that Amanahraya Unit Trust has applied to launch a global fund.

Another industry player, a senior manager at a unit trust firm, said that this latest move had been long awaited.

"It has been close to two years that the limit was revised to 30 per cent, and some of us had expected it to go up to 60 per cent," she said.

She said that this latest development would certainly enhance investment returns as investors would be given more options for a better risk-and- return profile for their funds.

Thursday, March 1, 2007

Great Bonus for Public Mutual Investors!

With regards to our market’s performance during the first half of today’s trading, I would like to reassure investors that our market fundamentals remain strong and we maintain our optimistic outlook on our market's performance over the medium-term. The KLCI opened at 1,189.58 points and declined 8.17% to a low of 1,136.01. However, as of 12:30 pm today, at the end of the day’s first trading session, the KLCI has already seen some recovery, closing at 1,162.91. From our analysis, coupled with feedback from fund managers, analysts and brokers, it is clear that our market’s performance this morning is not an isolated incident.

The sharp fall experienced early in this morning’s trading session was a knee-jerk reaction to the regional market slide caused mainly by the sharp decline of the China indices yesterday. We will continue to monitor the situation but I am assured that our market will maintain its growth position in the long run. Our economy is stable and the outlook for 2007 remains positive. Our public-listed companies also continue to demonstrate progress and provide good returns to shareholders. (Statement From Dato’ Yusli Mohamed Yusoff, Chief Executive Officer, Bursa Malaysia Berhad, 28 Feb 2007)

To some the current KLCI sharp fall is bad news as they are lossing a lot of money. But I think this is a great opportunity to Public Mutual investors in the long term as they can apply the buy low sell high concept. This is a double boon for them as concurrently Public Mutual is running the Award Appreciation Campaign. They will be able to buy at a lower price per unit and at the same time get 1% free unit.

Some of the unit trust investors have switch their equity fund into bond to lock profit. But to do this you have to know where is the lowest point before KLCI bounce back, so you can switch back from bond to equity and make profit. The safer method is to diversify your investment into bond and equity for investor with a large amount of money. But to long term investors who do dollar cost averaging they don't have to do switching. The dolar cost averaging method will ensure that the units will be bought at an actual cost which is lower than the average unit price over the same period.

I think it is a hassle to do the monitoring yourself and to run around to the Public Mutual office to submit your switching form every time there is a great change in the KLCI. This is the job for your fund managers, that is why you are investing in the unit trust fund and not investing directly to the securities in the KLCI.

Tuesday, February 27, 2007

What does it mean to me as an investor when public mutual offers 1% free units

Well if you as an investor invest RM50,000 and the current selling price of the fund is 25 cent per unit. What you will get is:

RM 50,000 ÷ RM0.25 = 200,000 units

1 % Free units = 2,000 units

Total units that you as an investor will get is 202,000 units. The total cost of your investment will go down to:

RM 50,000 ÷ 202, 000 = 0.2475 cents per unit

So those who take this opportunities to invest will reap attractive capital gains on his "enlarged" unit holdings when there is a market upturn.

Panduan Mengkayakan diri anda

Buku ini memberi pelbagai petua dan tips bagaimana dan di mana untuk kita mendapat rezeki yang murah dan melimpah ruah. Di samping itu ia juga memberikan panduan dan selok belok menghindarkan diri dari hutang..

Harga Pasaran : RM19.90 Harga Ahli VIP : RM18.90

-----------------------------------------------------------------

Dr. Danial Zainal Abidin

Buku ini membongkar rahsia kejayaan dan kecemerlangan individu sejak beribu tahun. Buku yang mesti dibaca oleh individu yang hendak berubah apabila dunia berubah..

Harga Pasaran : RM33.00 Harga Ahli VIP : RM31.50

--------------------------------------------------------------

Ustazah Siti Nor Bahyah Mahamood

Harga Pasaran : RM19.90 Harga Ahli VIP : RM18.90

Monday, February 26, 2007

Three Big Events Coming Up!

6th CAREER AND TRAINING FAIR 2007

6th CAREER AND TRAINING FAIR 2007

Venue: Mid Valley Exhibition Centre

Date : 6th - 8th April 2007, Fri - Sun

Operating Hours : 10.00am - 8.00pm

Malaysia's No. 1 career and training exhibition is into it's 6th year - with over 200 booths in Kuala Lumpur’s premier exhibition venue, the Mid Valley Exhibition Centre. Since 2002, this annual event has attracted over 180,000 fresh graduates, managers and professionals, filling up thousands vacancies ranging from top managerial to entry-level positions.

----------------------------------------------------------

4th Malaysia International Halal Showcase (MIHAS)

Venue : Kuala Lumpur Convention Centre, KLCC, Malaysia

Date : 9th May to 13th May 2007

Operating Hours : 10.00am - 7.00pm

MIHAS 2007 is a platform to further promote local halal products and penetrate the international market.MIHAS, which made its debut in 2004, has become an iconic brand name in the halal industry and is seen as an effective gateway especially to the global Muslim market. Last year, MIHAS attracted 27,523 visitors to its 505 booths. Forty per cent of its visitors were from the trade sector representing 60 countries.It is expected that MIHAS 2007 showcase will see a 25 per cent increase in the number of visitors especially so when both events are held back to back and at the same venue.

---------------------------------------------------------

International Islamic Fair 2007

Venue : Putra World Trade Centre, PWTC, Kuala Lumpur

Date : 27th - 29th July 2007, Fri - Sun

It is organised by SABA Islamic Media, with IFFM as the event organiser, and Islamic Information & Services Foundation (IIS) as a co-organiser, with kind cooperation of other Malaysian NGOs and support from relevant government bodies. Given the potentially attractive line up of exhibitors representing a wide range of business activities from all over the Islamic world, the Fair promises to be an annual Islamic event of choice.

Wide ranging products, services and activities await visitors - from books, children edutainment products, clothing and decorative items to Islamic banking and insurance, franchising, talks, conference, symposium and even charity performances.

Tuesday, February 13, 2007

More Local offerings poised for launch this year

A report by Standard & Poor’s Fund Services, dated January 23 2007, indicates that the average return on equity funds last year was 24.88 per cent, followed by asset allocation category of 17.74 per cent.

The Kuala Lumpur Composite Index (KLCI) in comparison delivered lower but still solid 21.8 per cent return in 2006.

“The above clearly demonstrates that unit trusts do deliver respectable returns. Of course, this is buoyed by the good performance of the local stock market in the later part of last year.” Federation of Malaysian Unit Trust Managers president Datuk Tunku Ya’acob Tunku Abdullah said.

The trend pursued by mutual fund companies since last year has been offshore-based funds, and this year alone four have launched such funds

The reason why these foreign funds sold like hot cakes was the poor performance of the local equity market, MAAKL Mutual Bhd chief executive officer and executive director Wong Boon Choy said.

But today, the tables have turned. The KLCI is shooting its way towards the 1,200-level and analysts remain bullish about the market.

In fact for 2006, MAAKL’s local equity funds outperformed the offshore funds, Wong said.

“Take, for example, the one-year period ended December 29 2006: the average total return of the local Equity Growth category was 25.87 percent versus the Equity Asia Pacific Ex-Japan category’s average total return of 22.78 percent,” he noted.

Fund companies unanimously agree that more local unit trust funds will be introduced this year to build up foreign investment capacity, pointing out that most of the 30 per cent of the foreign capacity is used up.

“We intend to launch local funds as the demand is always there. This is in readiness to build up our fund size for future foreign fund launches,” OSK-OUB Unit Trust Management Bhd chief executive officer Ho Seng Yee said.

And build it will. Even as competition increases and margins start to get squeezed, mutual houses have set ambitious targets for their fund sizes.

OSK-UOB plans to increase its fund size to RM3.5 billion this year from RM2.4 billion; MAAKL intends to launch between four and five funds this year to boost its fund size to RM1.5 billion; while RHB Unit Trust Management is working towards a RM1 billion target.

Source: New Straits Time, 6 Feb. 2007

Thursday, January 25, 2007

What do unit trust and a RM10 restaurant have in common?

There is this restaurant that sells each dish for RM10. You only have RM10. So when you go by yourself, you only can buy one dish. You may get the dish that is tasty or to your liking and you may not. But as you don’t have any more money, you have to eat it regardless.

But then if you take 9 of you friends who also have only RM10 each. You can buy 10 different dishes that can be shared. From the 10 dishes, you may like all or you may not. You can eat what you like and not what you don’t like.

This is the same with unit trust, where you can own 10 or more blue chip company equities with a small amount usually RM1,000. If you try to enter the share market on you own, you usually can afford to buy only one blue chip company. If the share price go up you are in heaven, if the price go down you are in hot water.

In unit trust the loss from shares that go down will be balanced by the gain from other shares that went up.

So guys, it looks like varieties do make it tastier and safer for all.

Thursday, January 18, 2007

Balancing Needs & Risks in Unit Trust Investment

For the balanced funds, the ratio of stocks to bonds is determined by the fund’s objective and the fund manager. On the average, their ratio of stocks to other investments is approximately 60:40. Managers of balanced funds can, however, shift ratio one way or the other to take advantage of high interest rates or stock market growth. These funds may be equity-oriented and skewed toward stocks, or income-oriented and skewed toward bonds. For Full Article Click Here

technorati tags: unit trust investment balance fund

Tuesday, January 16, 2007

Letter to a cousin......

Assalamualaikum,

I hope you are in great health. You mentioned that you are interested in investing in the unit trust for your children education fund.

You also mentioned that you do your savings at Lembaga Tabung Haji(LTH). I would like to suggest that you open two unit trust accounts. One for your children education fund, and another to maximized the return that you get from your LTH savings. Considering LTH did not give a high dividend, merely around 4.5%. The latest I heard, our inflation rate stand at 3.6% per year. With the dividend that you get from LTH you merely gain a value of 0.9% to your money.

So it is a waste if you keep a large amount of money in your LTH account. I suggest that you save only the amount that equal to your three months cost of living in LTH. This is your emergency fund or short term investment. The rest should be invested in a higher-yield investment. When you are ready to go for your Haj, you can transfer back the amount for your Haj back into the LTH savings. When you invest in the unit trust you can gain more than 10% a year. Below is a table to show you the difference of return that you can get when your initial investment is RM10,000 and additional investment is RM100 per month.

| Year | Lembaga Tabung Haji | Unit Trust Fund |

| 5 | RM 19,186.00 | RM 23,822.00 |

| 10 | RM 30,633.00 | RM 46,083.00 |

| 15 | RM 44,898.00 | RM 81,935.00 |

| 20 | RM 62,674.00 | RM 139,674.00 |

Going back to inflation, inflation also will increase the three years local university cost for your first born who is 3 years old from the current RM40,500 (local university fees including living cost) to RM 68,842.00 when he is 18 years old. For your second child who is 2 years old, it will be RM71,320.00.

Now days, it is hard to get any scholarship or education loan. In the future PTPTN may also be abolished as there are a lot of students who did not pay the loan after finishing their study. So it is important that you start a monthly saving for your children tertiary education. With a return rate of 10% a year you should put aside RM172 per month for your first born and RM 157.00 for your second child. As you can see here, the earlier you start the lesser amount that you have to set aside.

It is okay if you cannot afford to save the total of RM329 per month immediately, what is important is to start saving any amount that you can afford now. Who knows, you may get a big raise or receive an unexpected windfall in the future. Then you can top up your children fund investment.

So, good luck with your education fund savings and I hope all your dream and financial goals will be achieved.

technorati tags: unit trust investment education fund inflation personal financial planning

Wednesday, January 10, 2007

Is Your Retirement Fund Enough?

Did you know? Most Employees Provident Fund (EPF) savings will be finished after 3 years of retirement. Below is a table showing an estimate amount of EPF savings.

-

Category of workers*

Total savings at 55 years (MYR)

A

224,400

B

374,112

C

488,474

D

503,446

E

604,135

A - Factory worker that starts contributing at the age of 18 with starting salary of RM600 a month.

B - Factory worker that starts contributing at the age of 18 with starting salary of RM1000 a month.

C - Graduate that starts contributing at the age of 23 with starting salary of RM1500 a month.

D - Graduate with Master Degree that starts contributing at the age of 25 with starting salary of RM2500 a month.

E - Professionals that starts contributing at the age of 25 with starting salary of RM3000 a month.

Assumption : Contribution rate- 23 percent; Dividend Rate- 5 percent; Salary raise rate- 3 percent a year; Member contribute until 55 years old; Account is fully withdrawn.

Source: Financing challenges facing social security schemes: The experience of the Employees Provident Fund of Malaysia, Rusma Ibrahim, ms. 9

For a male factory worker B, if his living cost is RM800 per month then when he is 55 years old it will be RM 3,414.47 a month because of the Malaysian 4% a year inflation rate. So if you have RM374,112 at the age of 55 years old (already retired) and invest all the money back to get return rate of 8% a year, the money will be spend totally by the age of 66 years old when your living cost is RM 3,414.47 a month . But according to statistic Malaysian man lifespan is 70.4 years. So you will have 4 more years without money. This illustrate that EPF money is not enough to support your live after retirement.

So, additional saving other than EPF is very important for your golden years. Like Malay old folks saying, "To make ready the umbrella before the rain start". If we save a lot consistently while we are still strong to work, we don't have to work during our retirement years. We can concentrate on doing what we love and for Muslim, have more time for prayer and amassing good deeds.

technorati tags: EPF retirement fund saving financial planning

Sunday, January 7, 2007

The Four Distinct Phases of Financial Planning

- Many years of earning power ahead

- Plans to buy a home and start a family

- Willing to accept some fluctuations in investment, result in pursuit of long-term financials goals

Phase Two: The Acquisition Years (Mid-30s to Mid-40s)

- Income still climbing

- Establishes a tertiary education fund for children

- Willing to accept some fluctuations in investment, result in pursuit of long-term financials goals

Phase Three: The Accumulation Years (Mid-40s to Mid-50s)

- Family responsibilities are winding down

- Begins to think of retirement

- Seeks less vilatility in investment results by emphasising more income and capital preservation and less long-term growth

Phase Four: The Reaping-The-Reward Years (Mid-50s to Late Retirement)

- Retired or about to retire

- Years of earning high income may be over

- Plans retirement activities; and assesses ability to set up trust funds for grandchildren

- Seeks lower volatility in investment results

So where are you at right now?

technorati tags: Financial Planning Retirement Education Investment Saving

Tuesday, January 2, 2007

New Year Resolution!

Well if you are serious about starting the year with a good money management, you can start by purchasing "Buku Perancangan dan Penyata Kewangan Keluarga 2007" or

"Household Planning and Account Book 2007" release by Bank Negara Malaysia. It will help you in preparing budget and managing your household income, expenses, savings and investments. The book includes a section that features the concept of "Life and Financial Planning" for a family. It is aimed at providing greater knowledge and awareness in budgeting and financial management.

You can purchase the book at the Bank Negara Malaysia Money Museum, Kuala Lumpur; Bank Negara Malaysia branches in Penang, Johor Bahru, Kuala Terengganu, Kuching and Kota Kinabalu; MPH Bookstores and other selected book stores from today.

It only cost RM1.50.

technorati tags: Household Planning Financial Planning money management resolution

7 Formula Individu Cemerlang

7 Formula Individu Cemerlang